FAST's June Status Report

What's new in FAST: channel counts, new channels and more.

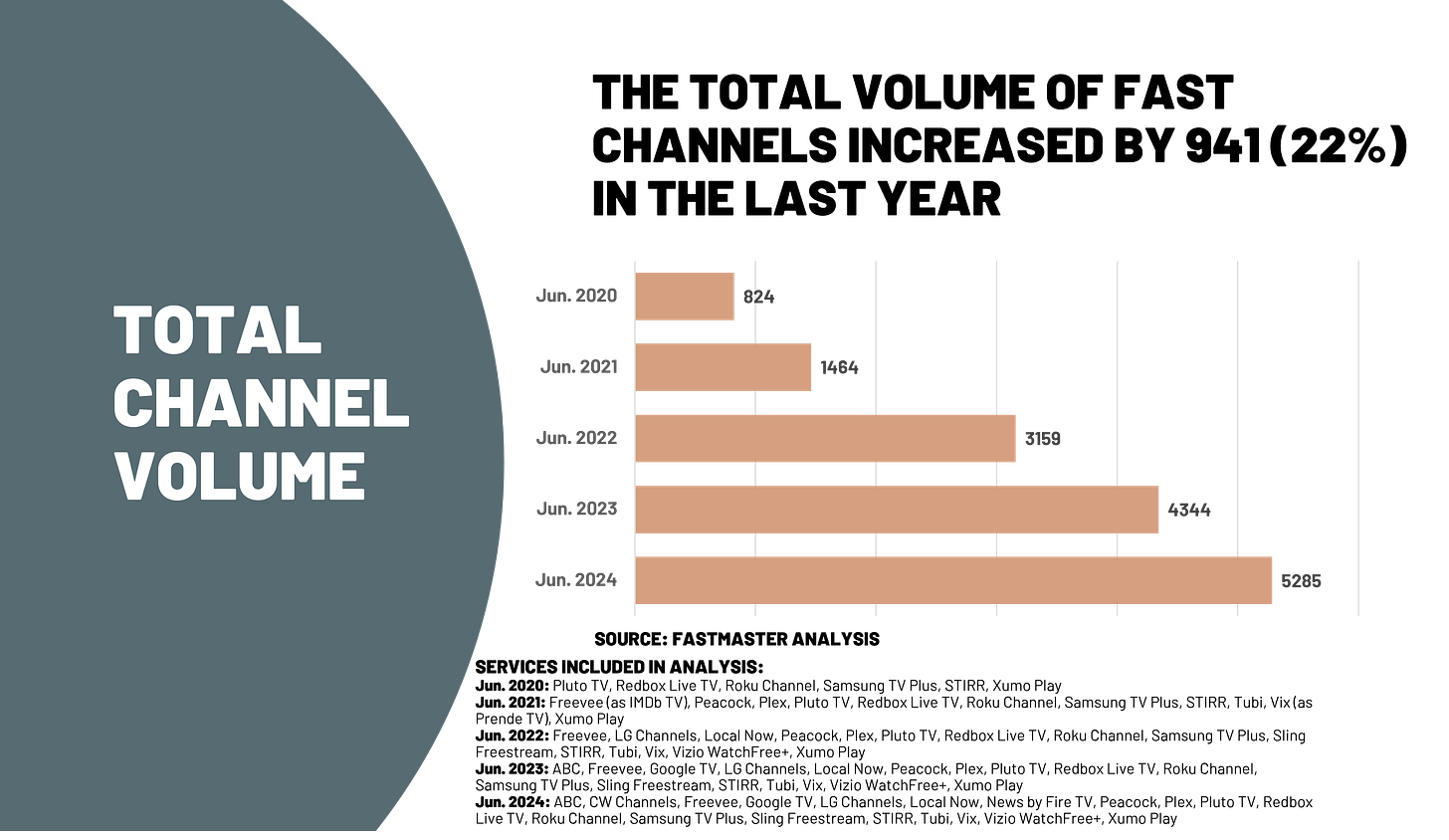

It’s that time we all look forward to, the FAST update for the month! You might have seen that I included a new metric, total channel volume, last month (thanks to Deadline for covering it, and to Jill Goldstein and Deana Dor for their work getting the story picked up). I thought that it was important to show that even if there is a channel slowdown in terms of total available channels, volume continues to grow (i.e., services keep adding more channels to their line-ups).

We’ll get into that very soon, but before I also wanted to share The Hollywood Reporter’s recent article on FAST which had a number of quotes from me (thanks again to Jill and Deana!). To those who were at the FAST Feast last week, it was lovely to see you all and a pleasure to co-host along with Tastemade (and the feast was genuine!). If you didn’t read my analysis of the ads on FAST and why Tubi perhaps shouldn’t be so mean about FAST in earnings calls, you can find that here on LinkedIn.

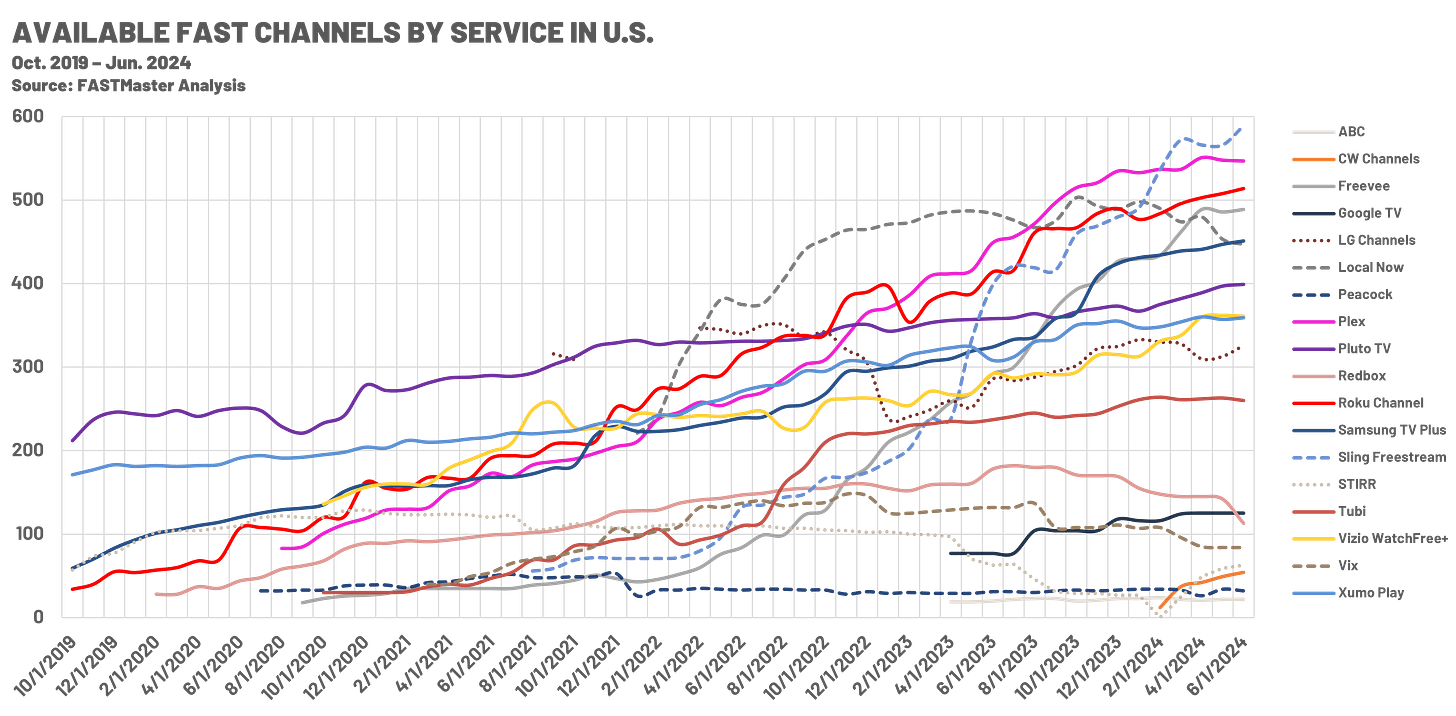

One final note before this analysis starts - there will be a separate analysis looking at the services themselves, what they added etc. This analysis will look at the overall market. The key thing to note here is that 40 new channels launched across the tracked services between May and June, most notably, from a brand perspective, National Lampoon, Grace and Frankie Channel, and Miramax Movie Channel.

This sees most services continue the uptick in channels offered, although Local Now and Redbox did see a number of channel departures (Redbox seeing almost all Fremantle-owned channels going off the platform, alongside Sony ones).

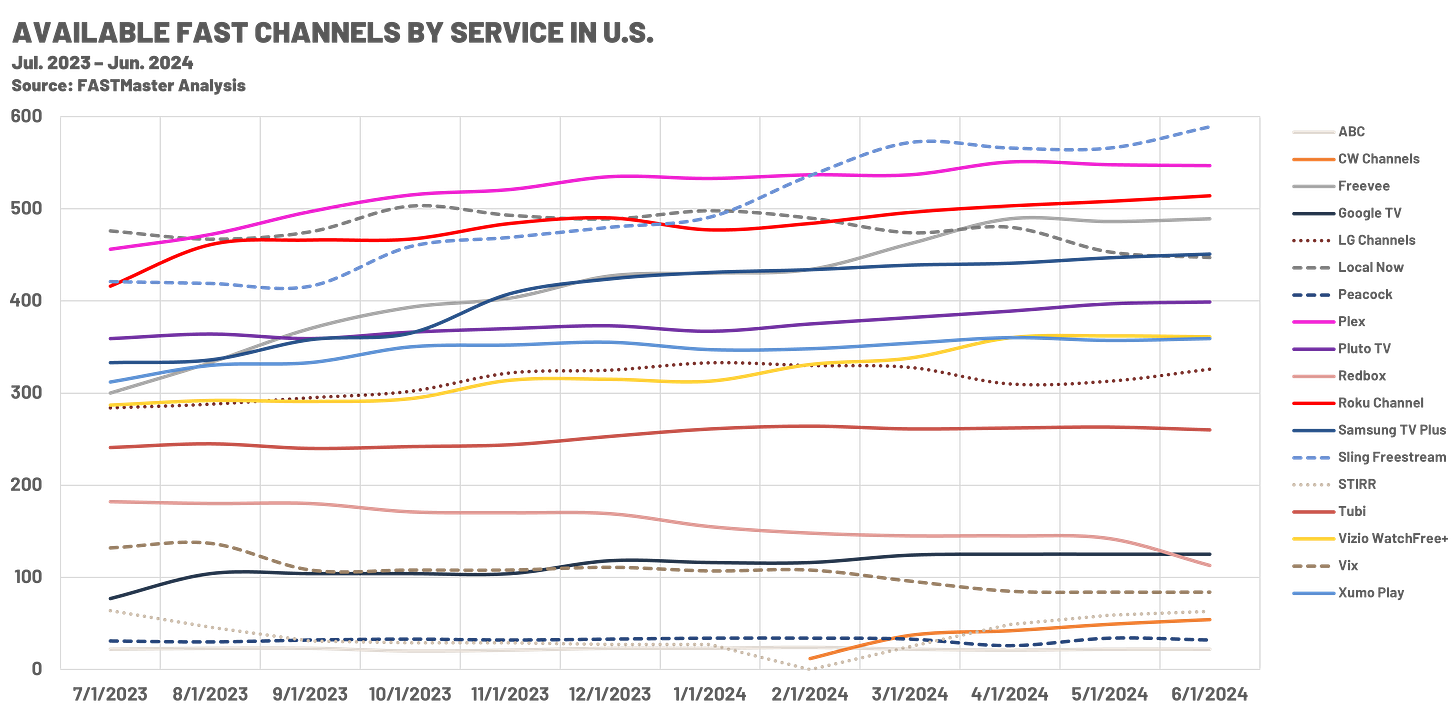

Perspective is key in analysis and so here’s the channel counts for just the last 12 months. A little easier to decipher and shows more of a flattened growth for many services as the domestic market matures.

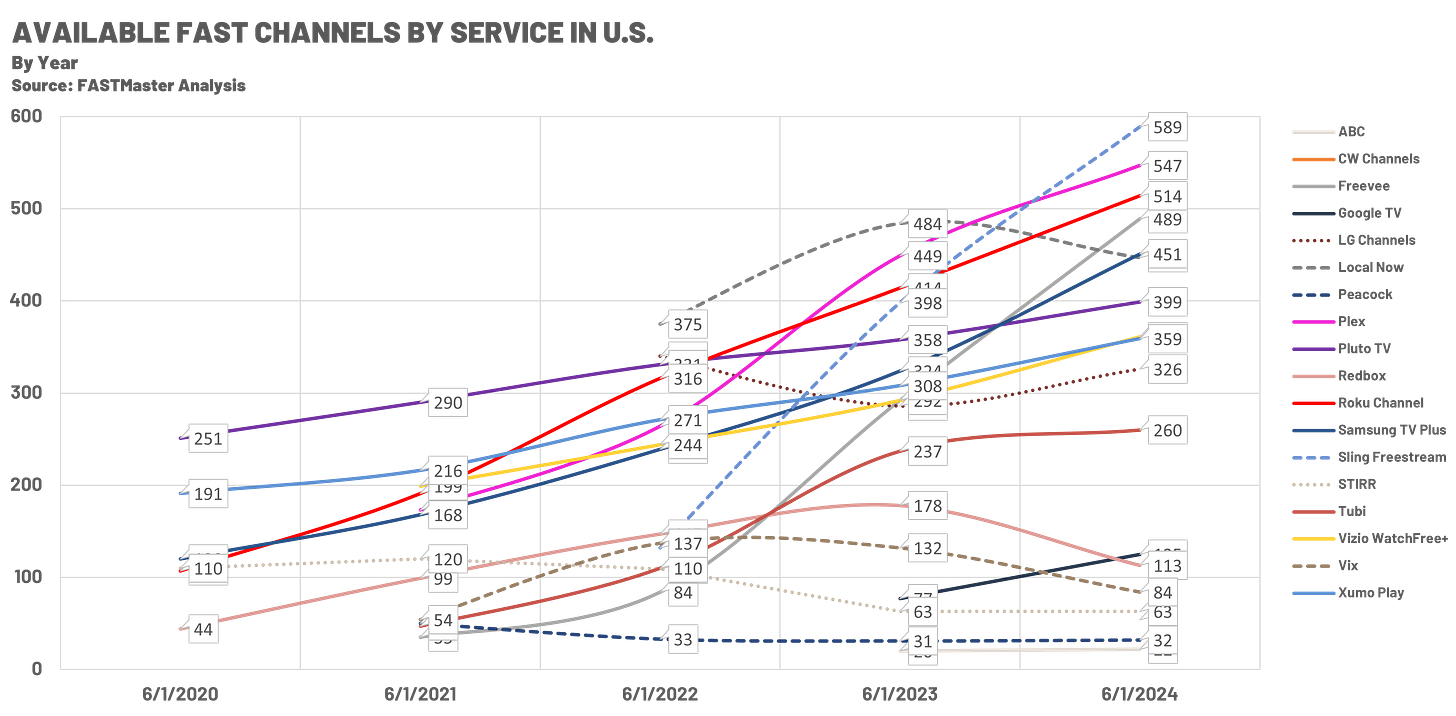

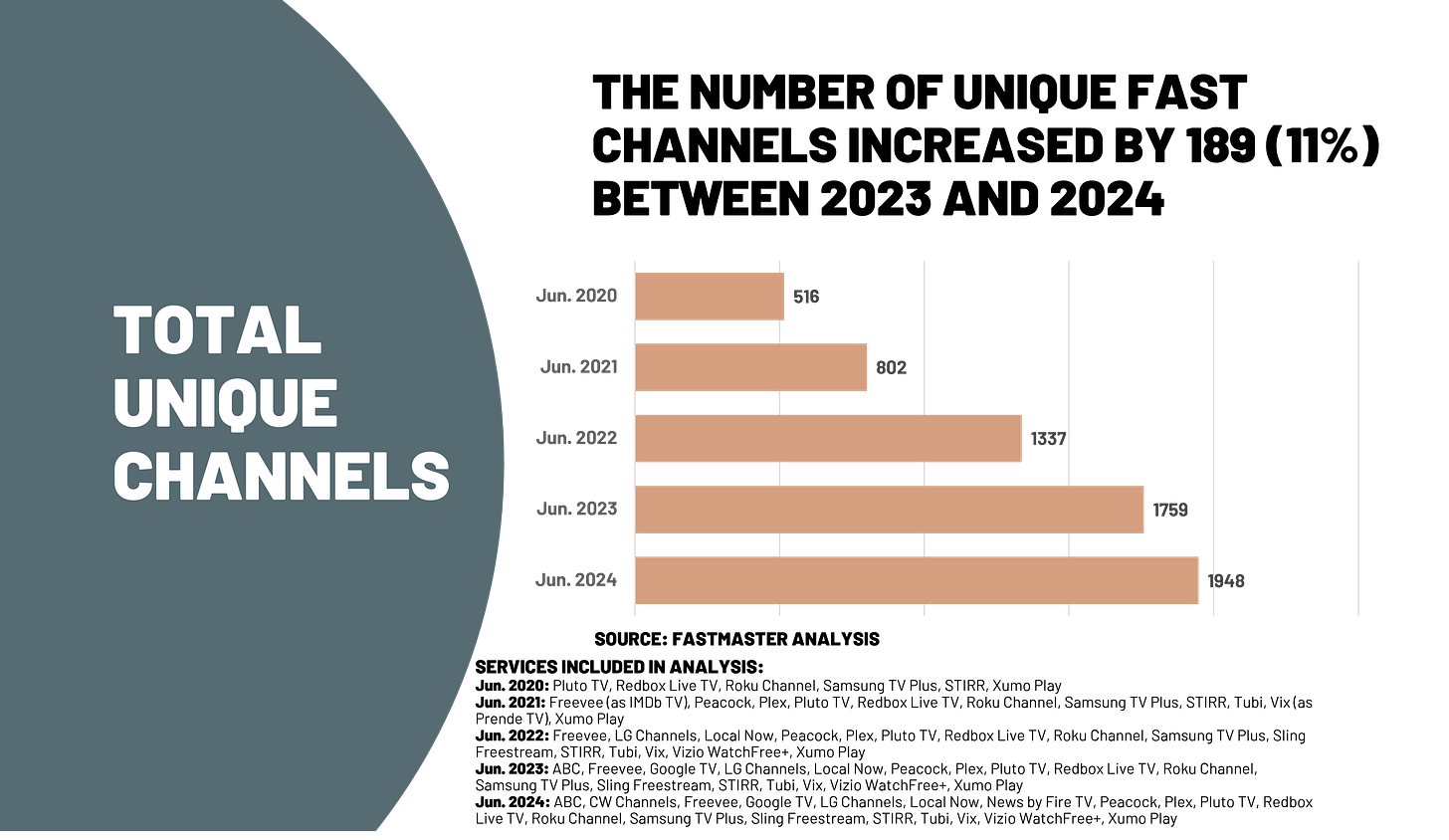

I added channel counts to this one so the year-over-year growth trends are visible. What’s clear is how far FAST has come in the last four years with channel counts now alien back then (as would be the number of channels available from big media brands).

The total volume of channels available across tracked FAST services now amounts to 5,285, an increase of 22% on the prior year. Some of this is due to new services launching (CW Channels) or being tracked (News by Fire TV), but they amount to ~110 channels between them. Instead this highlights the continued growth of channel line-ups, as 500 becomes the new 400.

Year-over-year there has been an 11% increase in unique channels available on at least one service. The 1,948 is a slight increase over May’s 1,943 but remains below April’s record of 1,963. What’s clear however is that the frenetic pace of unique channels being added to the FAST space is slowing as 2024 has seen a much lower monthly growth rate versus prior years. And yes, if 40 channels were new to FAST this month, but the total available channels only grew by 7, that means 33 channels from May are no longer carried by any of the tracked platforms.

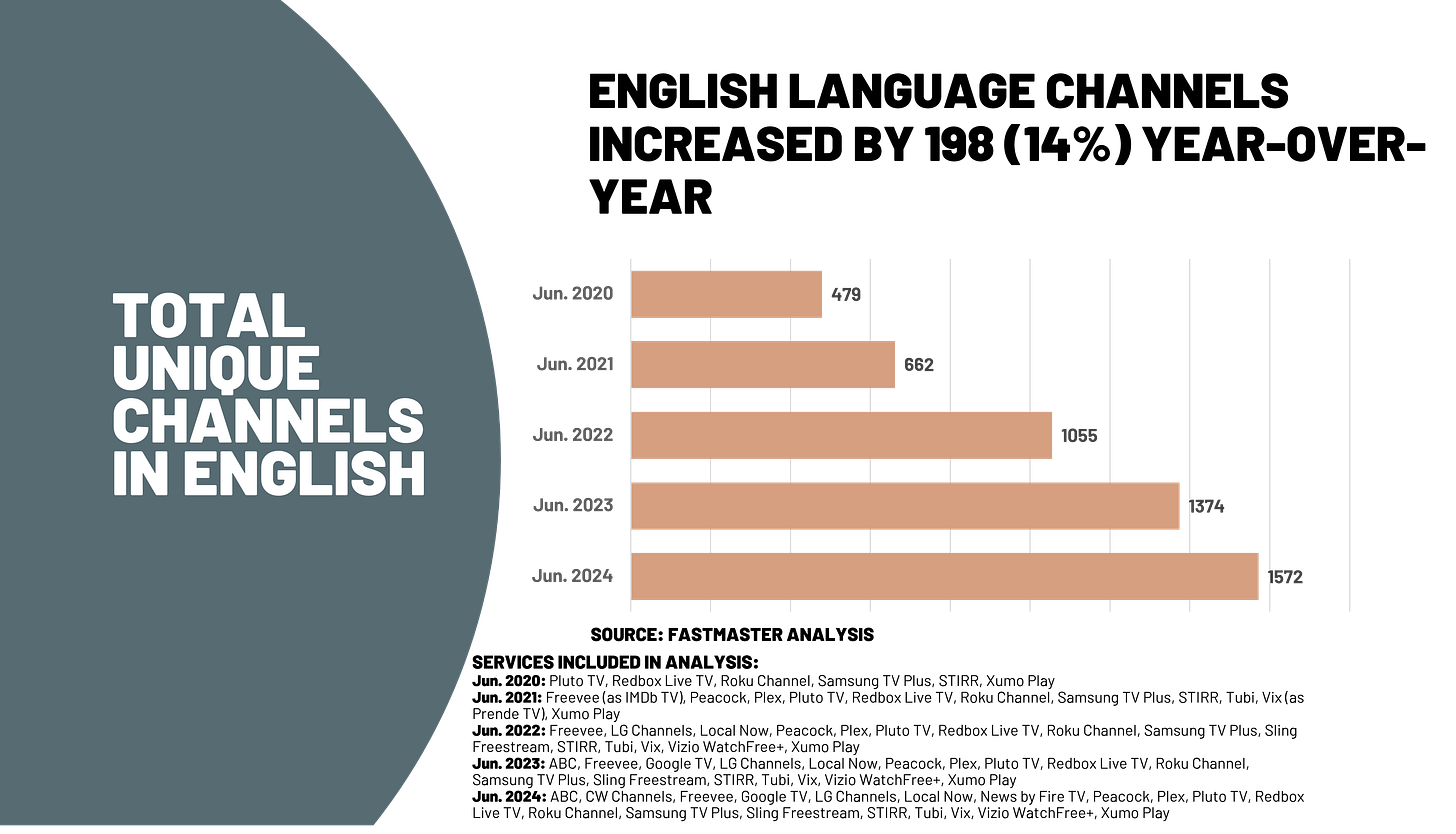

English-language FAST channels look robustly healthy, with close to 200 more available than at this time last year.

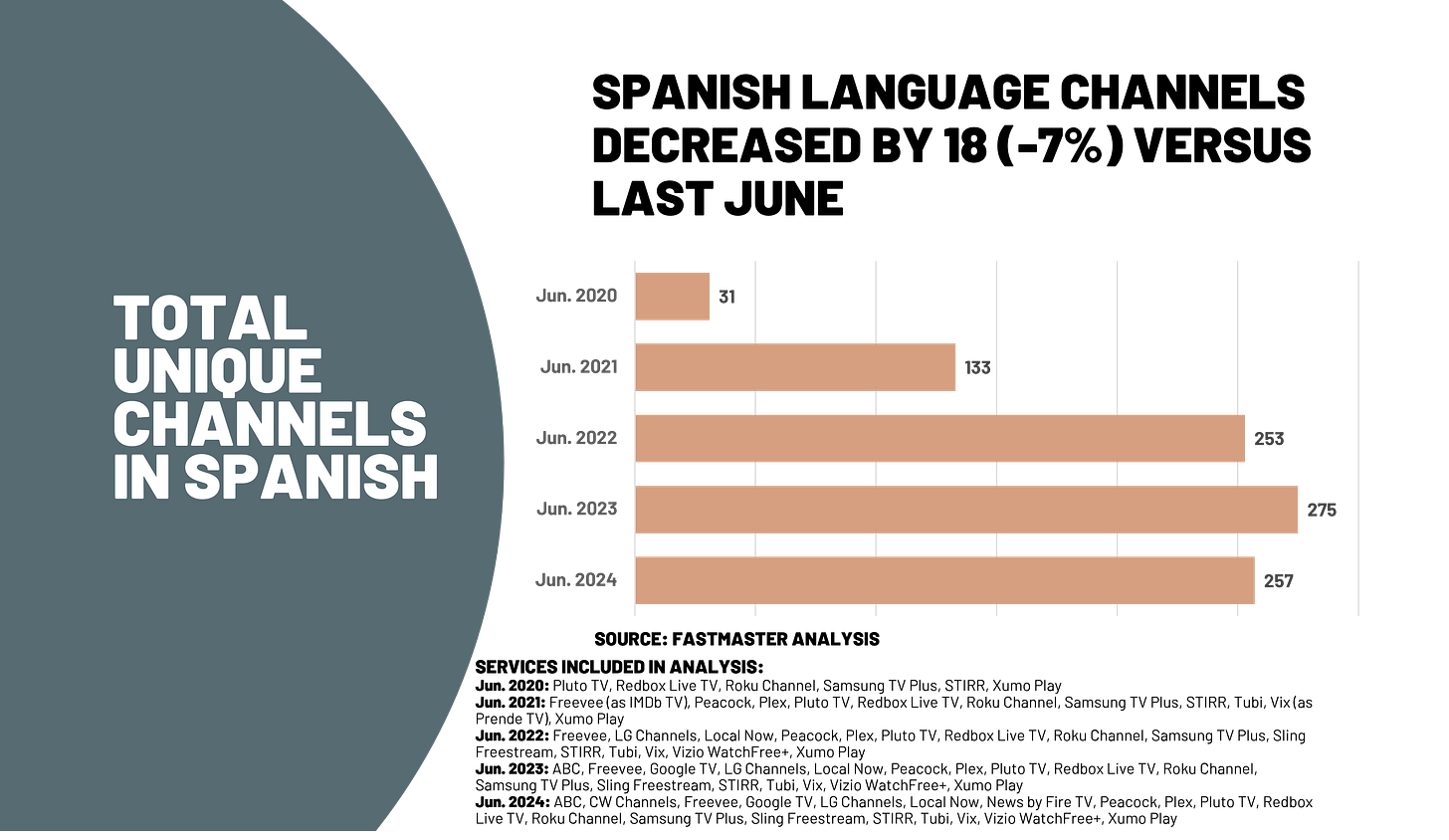

This is in stark contrast to Spanish-language channels, which have seen a decline year-over-year. As I have noted before, this suggests to me that the market for watching content in Spanish matured quicker in the U.S. than the English-viewing market, and given how even ViX has continued to trim its channels, demonstrates that while there is an audience for Spanish-language FAST, it may have capped out. (Now the other argument is that perhaps if more Spanish speakers knew about what was on FAST and there were other content available, perhaps some more modern shows, viewership and channel counts would grow).

I would love to get a data on the graphs here! Would you be kind enough to share them with me sir?