FASTMaster State of FAST Report: Greatest Volume of FAST Channels Ever in May

Read on for insights into the number of unique channels, volume of channels and more key trends to be aware of in FAST

I’m very happy to be able to announce another FASTMaster report to add to the repetoire: the State of FAST for May 2024 (you might have seen the exclusive on this in Deadline or coverage on World Screen, Advanced Television, Cord Cutters News, The Desk and more - big thank you to my friends at JGoldsteinPR!). This complements the Key Trends in FAST as that report looks into the trends within the tracked FAST platforms whereas State of FAST looks at channel volume and trends within the over-arching genres (depicted thusly below):

Some key highlights will follow but first some housekeeping. I recalculated the base for channel calculations, removing Peacock’s PAST channels from the equation. For services which provided their data for a limited amount of time (TCL TV+, VIDAA) or are erratic and hard to find (Fire TV Channels), I removed these too so that the data is consistent across the tracked time period, which for this report I began at January 2022.

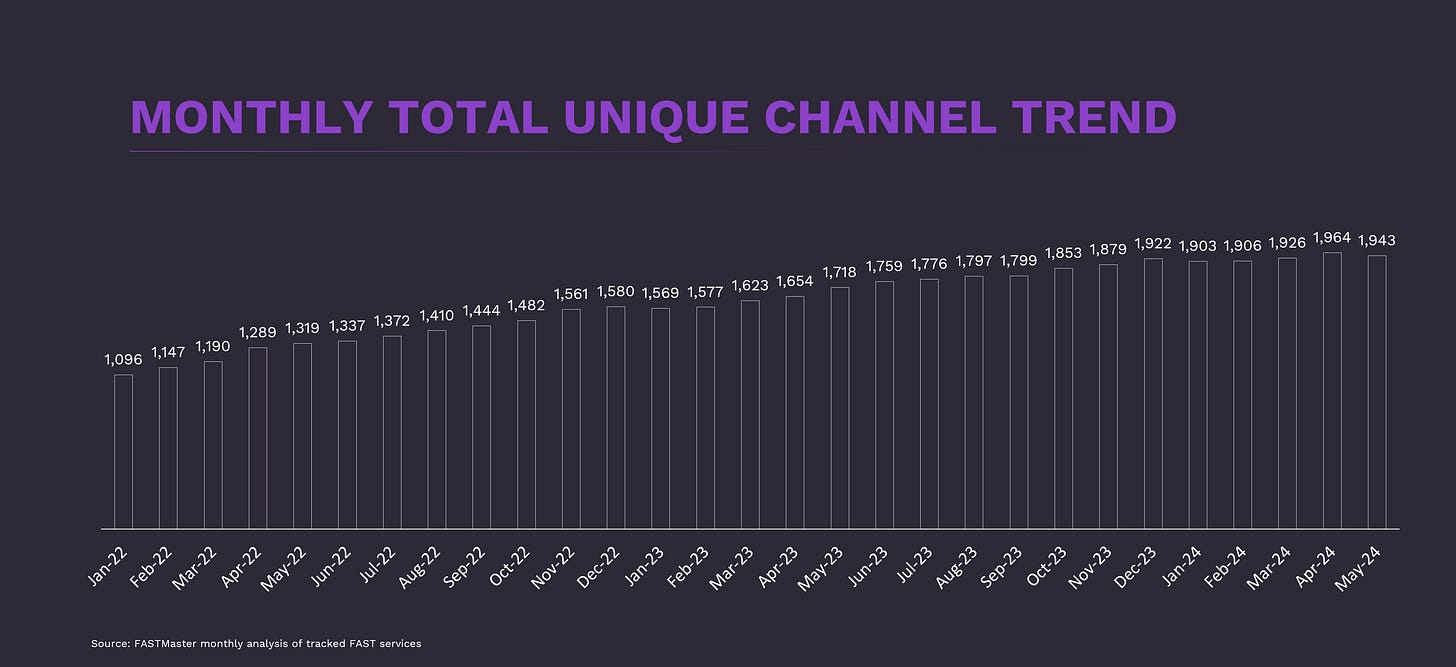

This re-imagining of the total unique channels available in FAST sees April 2024 as the high-water mark (1,964) with May falling a little to 1,943 but is the second-greatest total in history. A key factor behind this is Local Now—not to point the finger of blame at anyone—which trimmed 42 channels from the service in the last month including many Allen Media Group owned-and-operated channels. Recent channel chopper at large, Vix, arrested their recent trend of cutting Spanish-language channels (-14 in March, -11 in April, -1 in May) but questions still remain for me about how many Spanish-language channels the U.S. market can support given the overall recent reductions in total channels.

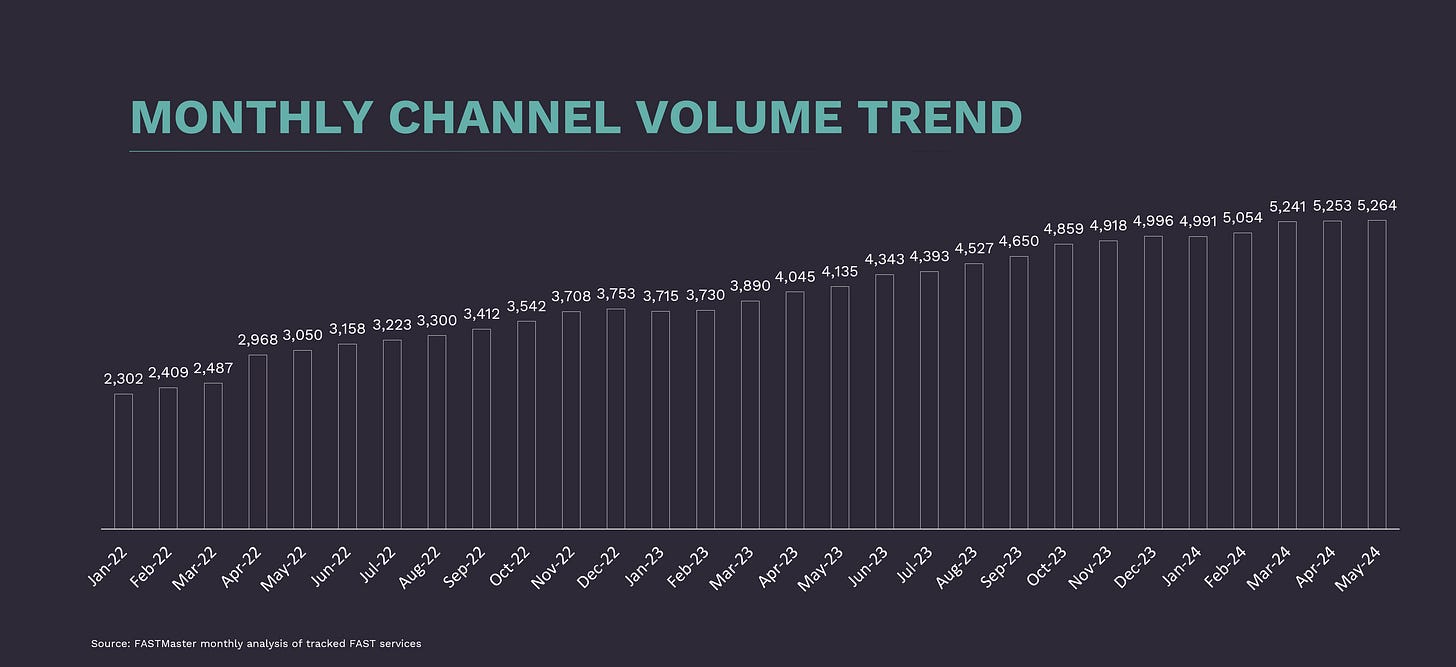

Here’s a brand new FASTMaster metric to regale - channel volume. This looks at the total number of unique channels and counts each time they appear on a tracked platform (hence my need for consistency among platforms in the dataset). As the headline of this article has spoiled, May has the largest number of channels on offer ever. This is not the greatest surprise as most services continue to grow, but as I say in the introduction to this report: this is Peak FAST.

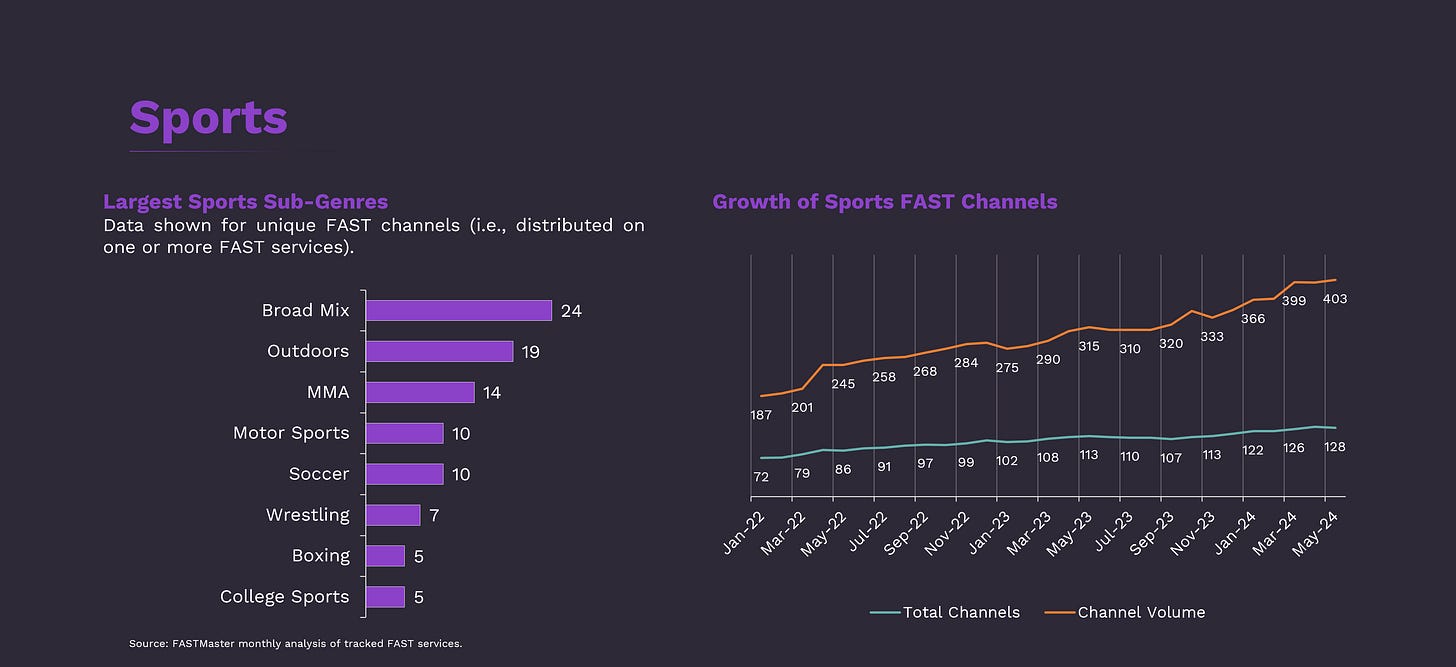

The new report also breaks out channel trends by genre, with Sports above illustrating what’s available for the five overarching FAST genres: General Entertainment, Movies, Music, News and the aforementioned Sports.

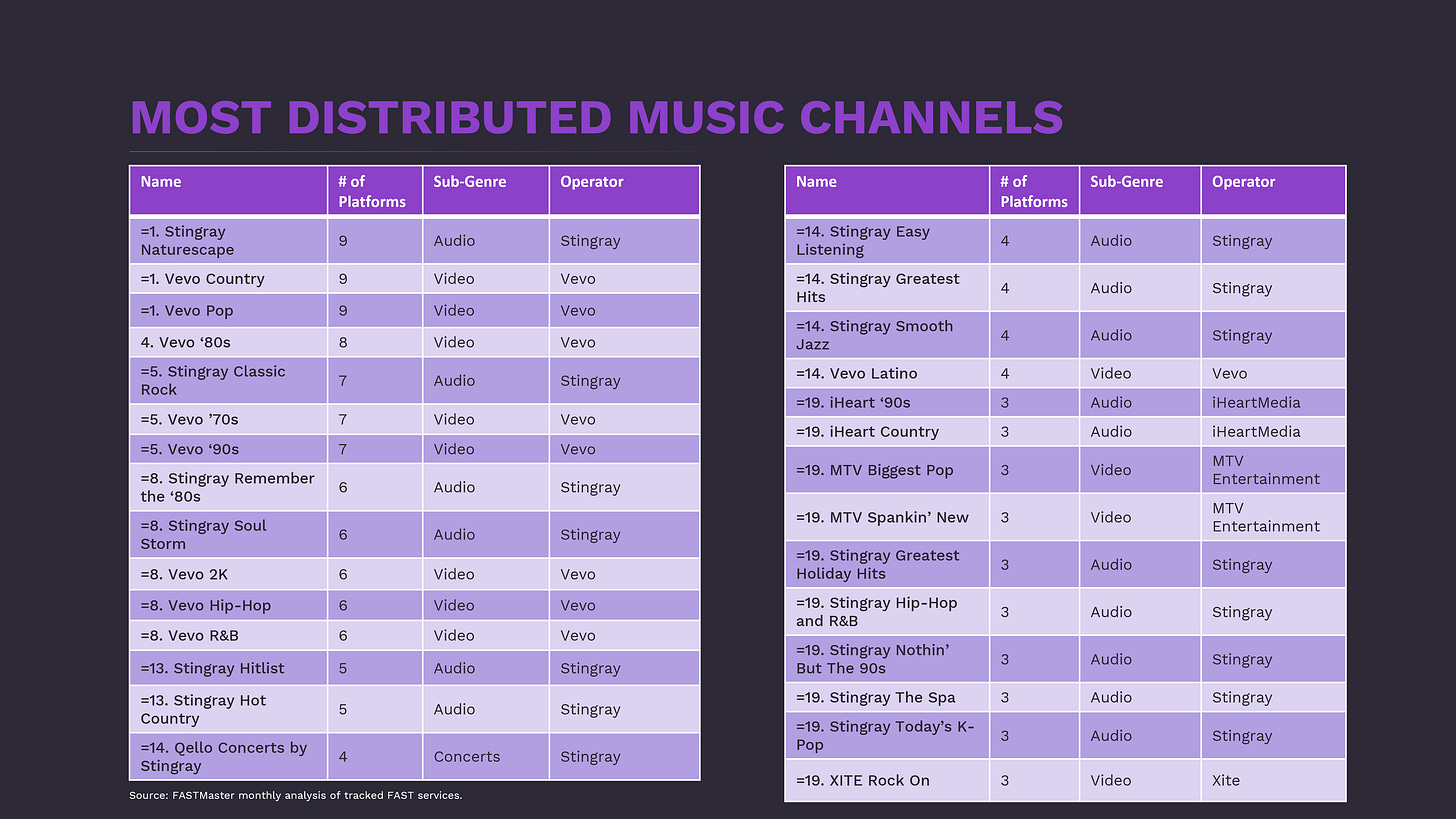

Given how much everyone seemed to love those most-distributed channel lists, I threw them in by genres too. As can be seen from the music example above, Stingray and Vevo have music locked down for audio and video distribution respectively.

(Subscribers can access the full report to download below).

You can find the full report here to download and read. Do let me know what you think!